Terms for Subscriptions, Auto-Renewals and Payments

Subscriptions, auto-renewals, and payment clauses explain to a consumer how these features work and how you expect remittance for them.

This article will teach you what these clauses are, where to place them, and what type of information they usually contain. We will also provide examples of these clauses in real-life legal agreements.

What is the purpose of Subscriptions, Auto-Renewals, and Payments Clauses?

These clauses cover a legal agreement between a business and a consumer to obtain payments in the foreseeable future.

In essence, you, the business owner, and the client agree that the client will pay you a certain amount of money in exchange for services or goods for a stipulated period. The period can be weekly, monthly, after six months, or yearly, depending on the type of service or goods you provide. Such exchanges usually happen frequently until the client, or the company ends the agreement.

These clauses cover a gap that basic, traditional contracts, which mainly focus on a single monetary exchange, can't meet.

Benefits of Subscription, Auto-Renewal, and Payments Clauses

Obtain consistent recurring revenue

Most business owners cannot achieve and maintain cnsistent revenue. Which in turn means fluctuating profits and slow business growth.

Subscription, Auto-Renewal, and Payment clauses allow you to capture a consumer and turn them into a lifetime customer.

Your company will have achieved recurring revenue and consequently stable profits when you do so.

Establish a solid customer base

It takes less effort to establish a long-term relationship with a buyer that regularly returns to your shop than with new customers who walk in. By having Subscription and Auto-Renewal clauses, you save on time previously spent acquiring new customers.

These clauses also foster a sense of belonging among your customers. Allowing them to feel they are an integral part of your business. Which, in actuality, they are.

Facilitates customer retention

Without a doubt, businesses that have Subscription, Auto-Renewal, and Payment clauses retain customers longer than those without such clauses.

Why is that so? It mainly has to do with the fact that the customers will interact with the company's service or product longer. The extended interaction period allows the business to foster a relationship with the client by providing personalized subscriptions. All of these features make customers stick around longer.

Increase customer lifetime value

A consumer's lifetime value (LTV) is of utmost importance for companies operating eCommerce stores. Once you achieve recurring revenue using Subscriptions, Auto-Renewal, and Payment clauses, you'll notice the LTV rise. That's because the autorenewals ensure the customer continues obtaining goods or services from you.

Companies having these clauses in their contracts increase a customer's LTV by up to 200%.

Reduce customer acquisition costs (CAC)

Marketing efforts are time-consuming and expensive. Therefore, you must choose the right campaign to enhance your visibility. However, even well-planned and properly executed marketing strategies which attract new customers are costlier than customer retention strategies. You avoid spending resources on customer acquisition by having Subscription, Auto-Renewal, and Payment clauses.

Allow for better financial forecasting

Thanks to the Auto-Renewal clause, your business will have a consistent flow of revenue.

In addition, you will have an easier time setting financial targets since you will have many regular paying customers.

When Should You Use These Clauses?

Subscription, Auto-Renewal, and Payment clauses are ideal for businesses seeking recurring income. For example, you can use these clauses if your company:

- Provides users with a streaming service that requires a monthly payment

- Has a security or writing software tool where the customers will have to make weekly, monthly, or yearly payments to use it

- Provides a cleaning service such as garbage collection every third week

Traditionally, these clauses usually start with an introduction period offered by the business at a discounted price or free.

If the consumer doesn't cancel the subscription after the end of the "trial" period, the company can continue providing its services or goods at the regular price.

Where Should You Include These Types of Clauses?

You should include Subscriptions, Auto-Renewals, and Payment Clauses in:

- Terms and Conditions Agreements

- End User License Agreements (EULA)

- Software license Agreements (SLA)

- Software as a Service Agreement (SaaS)

- Platform as a Service Agreements (PaaS)

- Infrastructure as a Service Agreements (IaaS)

We recommend following specific guidelines when including Subscriptions, Auto-Renewals, and Payment Clauses. These guidelines help to build trust and ensure the customers don't feel ripped off:

- Do not hide or try to downplay any information. For instance, using dull colors, smaller letter sizes, or crowding the words together.

- Ascertain that the client has adequate time to read through all the clauses in the agreement before signing the contract.

- Present these clauses alongside critical information like the purchase price. Don't place it in a hard-to-notice area such as a footnote.

How to write Subscription, Auto-Renewal, and Payment Clauses

Depending on the business you are running, below are the primary points to address in these clauses.

How often and when will the customer be liable for more payments

Explain to your potential customer how often and when you will require fees for the goods or services. This is also known as the renewal date and cost.

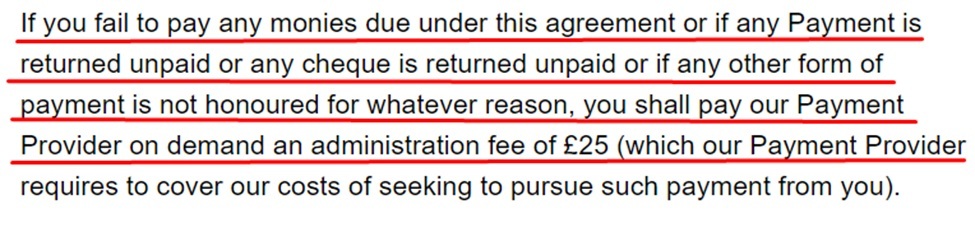

You can even include particular dates for more clarity. Remember to state what will happen if the customer fails to pay for the subscription. You can see how allGym does this perfectly:

Furthermore, you will have to explain if the cost of future payments will remain constant or if you will increase it. Also, describe how you will inform your customer about the price increase.

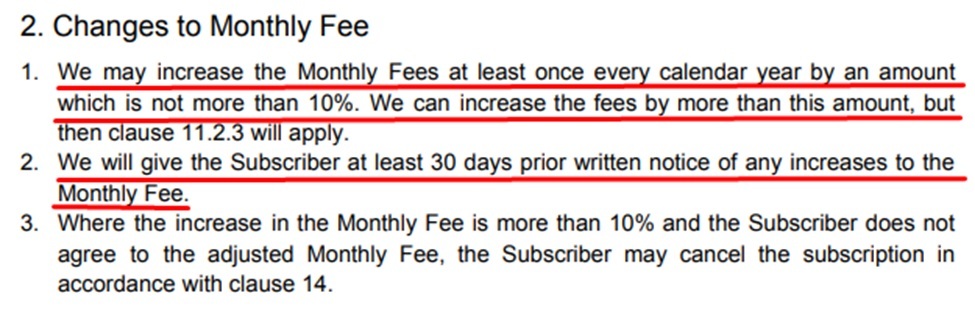

Showmax explains that it has the right to increase payments once yearly and will let the client know 30 days prior:

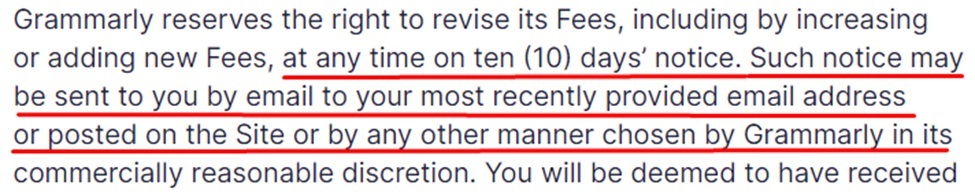

Grammarly aims to be transparent with its customers by elaborating on when and how they will get notifications of price increments:

When and how many times will you send reminders for auto-renewals

You need a well-written and transparent policy that states when and if you will send reminders about a future renewal payment. The policy should also include the method you will use to send the reminder.

Sending reminders will help you confirm with the client whether you have the correct contact details, for example the name of the client and credit card information. You should send the reminder a few days before the specified renewal date so your customer has a chance to cancel the transaction and avoid future remittance.

The above step is of utmost importance, especially if you have a minimum notice timeline. By covering all these aspects in your renewal clause, you will be bound by them legally. However, this is fine for many ethical businesses.

When and how can the client terminate the agreement and therefore be free from future payments

Inform your customers how they can practice their right to terminate the agreement and avoid future charges. The explanation should encompass how they can reach you and what the customer should say.

To reduce the chances of a court declaring your clause null and void or unfair, make it simple for the consumer to terminate the agreement. For instance, stating that the client has to personally submit a cancellation request or call a pricey phone line isn't ideal. It may cause legal issues.

You will also have to outline the effects of a consumer canceling the agreement. For instance, inform the client if they can access your service or goods until the following payment date or if it will end immediately after cancellation.

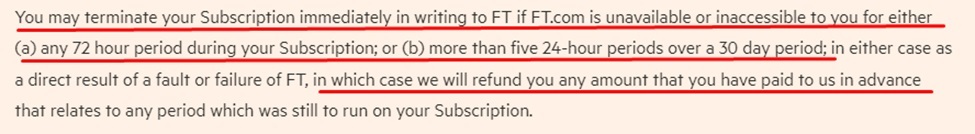

The Financial Times provides information on how and when a consumer can cancel the agreement. It also states that it will refund all the payments made before the cancellation:

Your business or company rights

Include a clause explaining whether you can make any changes to the services or products you provide. Also, explain if the changes made will necessitate an increase in the price and by how much.

Remember to add the right to terminate the agreement and discontinue supplying the service or product.

You should also explain scenarios that may lead to you terminating the contract. Hulu states its rights and reasons it may have to suspend or terminate a customer's subscription:

Now that you understand how to write Subscriptions, Auto-Renewal, and Payment Clauses, let's look at the legal aspects.

Legal Requirements

There are plenty of laws all over the globe that give guidelines on how a business uses subscriptions, auto-renewals, and payment clauses. Some of these laws also state the type of information you should provide to potential customers.

In the United States, many courts will consider such stipulations legally binding, provided you write them in clear and straightforward language. On the other hand, some states have laws detailing specific elements that must be present in these clauses.

For instance, California laws state that the information should be conspicuous and unmistakable. Placed next to the signature line and made visible using a color different from the surrounding text or a bigger font size.

The state of New York has a similar "conspicuous and unambiguous "requirement. However, it goes further, stating that companies or businesses should notify consumers 15 to 30 days before the renewal date.

In the United Kingdom, consumer contracts considered unfair or exploitative are unenforceable. It explains that renewal terms are only fair if they provide uncomplicated information explaining how renewal occurs and how to cancel it.

The contract should also bind the seller to send the client a reminder for future renewal. Courts consider "unfair" terms to be:

- Giving little warning

- Imposing costly penalties

- Requiring customers to follow a lengthy procedure to end the agreement

In Australia, the laws state that Subscription, Auto-Renewal, and Payment clauses are legally binding, provided they don't cause an imbalance between customer and the supplier.

What you include in your clauses isn't only about following the laws. Providing well-written, comprehensive, and easy-to-understand information in all your agreements will build trust among your customers. You will also gain more customers as the clients share their positive experiences with their friends.

Most countries are strict with their consumer laws policies because some businesses depend on a lack of clarity and confusion to obtain money from clients. Therefore, such laws are put in place to protect unsuspecting customers.

Privacy Laws to Consider

Most people assume privacy data laws don't have a connection with auto-renewal and subscription clauses. That's because the clauses are more about the commercial exchange of goods and services, not personal data.

The two are directly connected. You will require personal data to process renewal payment or subscription such as a customer's:

- Bank account information

- Name and address to be able to ship the goods

- Email address for account identification

- Preference for particular services or goods, which in essence, is personal information

All this information is critical since numerous personal data laws depend on a customer's awareness or consent to make processing legally acceptable.

If a business owner can clearly show that the consumer was anticipating an auto-renewal, it will be easier to prove they agreed to provide their data.

Below are some laws where such issues may arise.

California Consumer Privacy Act (CCPA)

CCPA, which encompasses numerous businesses providing goods and services to California residents, doesn't need prior consent to process personal information. Even so, it establishes and enforces a right for customers to know that a business will process its data.

Therefore, your Software License Agreements or other similar documents must clearly state that you may use a customer's personal information to process future payments. You will also have to include when such payments happen.

Personal Information Protection and Electronic Documents Act (PIPEDA)

Most Canadian businesses fall under the PIPEDA act. The law requires a company to acquire a user's consent before processing personal data. In simple terms, the customer should understand the consequences of providing consent.

General Data Protection Regulation (GDPR)

GDPR, which directs data processing in European Union countries, states you should have legitimate reasons to process information. The regulation further explains that the customer must allow and expect you to process information in a specific way. Such won't be possible if the client never consented to future payment processing.

Virginia Consumer Data Protection Act (VCDPA)

The VCDPA states that businesses providing goods and services in Virginia must explain to consumers how they will process their data.

Summary

Let's go over what you need to understand concerning Subscriptions, Auto-Renewal, and Payment clauses.

- Firstly, these clauses are ideal for businesses requiring regular client remittances, for instance, a subscription service model. Often the clauses take effect after a free or discounted introduction period.

- Secondly, privacy laws do not directly affect such clauses. Nonetheless, numerous privacy laws demand that customers consent to processing their data. Some require the client to understand how a business will use its information.

- Thirdly, plenty of laws state that such clauses are only legally binding if they are straightforward to understand. Some require the clauses to benefit the client and the business equally.

When writing these clauses, remember to include:

- Renewal price and any potential rises

- Renewal dates and timetable

- How and when will you remind your customers about forthcoming payments

- How and when can the customer terminate the agreement

- Your rights

Always present the clauses:

- With similar prominence to other parts of the contract. You can use bold text or a larger font size

- Before the client signs any commitment